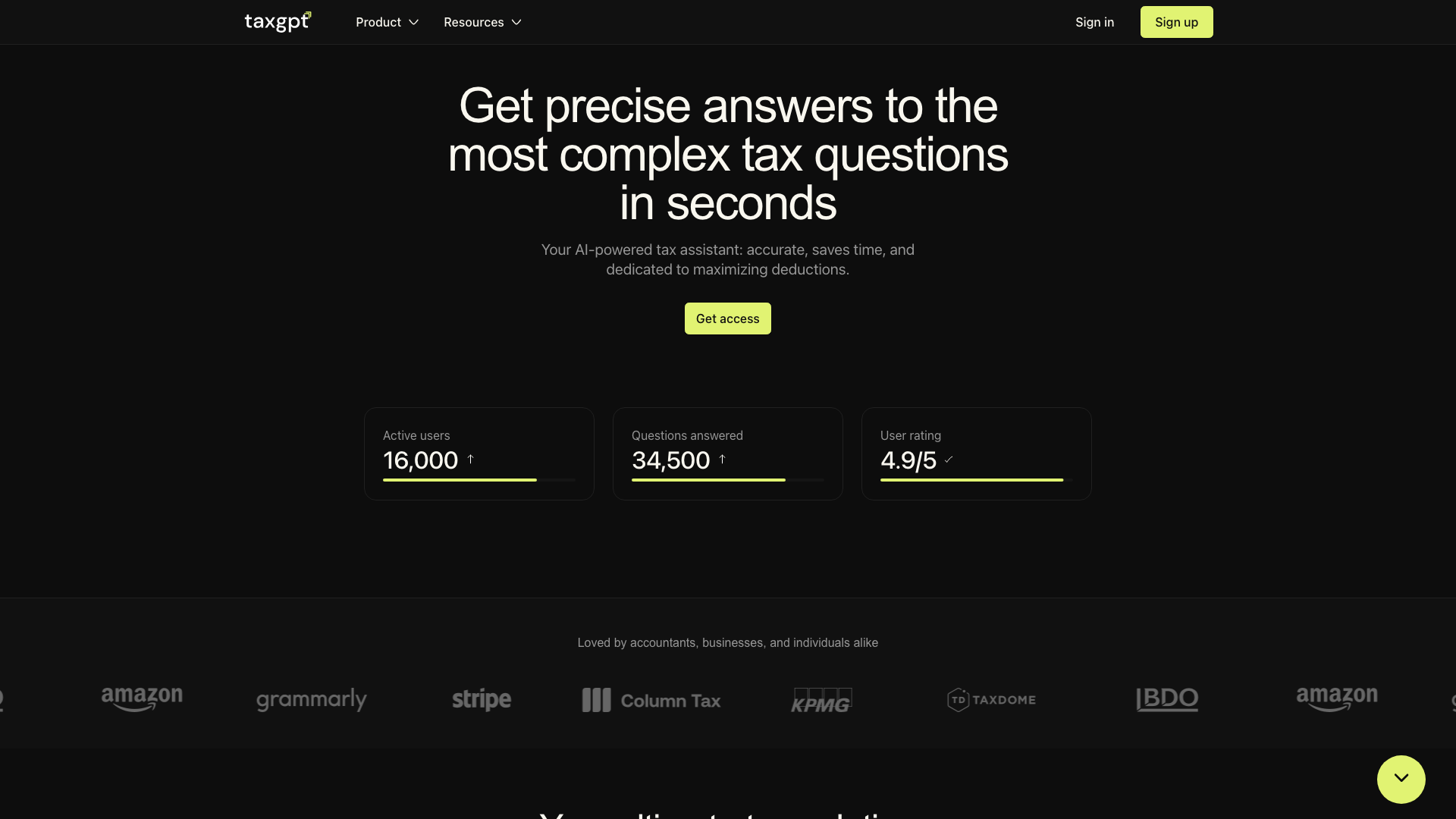

What is TaxGPT?

TaxGPT is your AI-powered tax assistant, designed to simplify your tax journey, whether you're an individual, a business owner, or a tax professional. We leverage the power of artificial intelligence to provide accurate, up-to-date tax information, helping you maximize deductions, understand complex tax laws, and file your taxes with confidence.

Features

-

AI-Powered Tax Answers: Get instant, accurate answers to your tax questions 24/7, 365.

-

Hallucination-Free: TaxGPT is built with proprietary hallucination control algorithms, ensuring the information provided is based on reliable tax data and sources.

-

Maximized Deductions: Identify eligible deductions and credits to ensure you're not overpaying your taxes.

-

Time-Saving: No more scouring through tax documents or waiting for responses. Get instant answers and streamline your tax process.

-

Secure and Confidential: Your information is protected with state-of-the-art security measures.

How to Use TaxGPT

Simply type your tax question into the chat interface. TaxGPT will analyze your query and provide you with a clear, concise answer based on its vast database of tax laws and regulations.

Pricing

TaxGPT offers a free tier with five questions per month. For unlimited access and additional features, we offer various subscription plans tailored to individual and business needs.

Comments

-

"Finally, a tax assistant that doesn't make me feel like I'm talking to a robot!" - John S.

-

"TaxGPT saved me hours of research and helped me find deductions I didn't even know existed." - Sarah M.

-

"As a tax professional, TaxGPT is a game-changer. It's accurate, efficient, and helps me provide better service to my clients." - Michael P.

Helpful Tips

- Be specific with your tax questions. The more detail you provide, the more accurate and helpful the response will be.

- Double-check the information provided by TaxGPT with official sources. While TaxGPT is highly accurate, it's always best to verify information before making any tax decisions.

- Take advantage of TaxGPT's free tier to explore its capabilities and see how it can benefit you.

Frequently Asked Questions

Q: How does TaxGPT answer my tax questions?

A: TaxGPT uses advanced artificial intelligence and a proprietary dataset of up-to-date tax information to provide accurate answers. It analyzes your query and searches through a vast database of tax laws and regulations.

Q: Does TaxGPT hallucinate or provide wrong information?

A: TaxGPT is designed to minimize the risk of hallucinations. We use proprietary hallucination control algorithms and constantly update our data to ensure accuracy. However, TaxGPT is still in beta and should not be considered a substitute for professional tax advice.

Q: What if the information provided is wrong?

A: We value your feedback! If you believe the information provided is incorrect, please let us know. Our quality assurance team reviews all feedback and works to improve the accuracy of TaxGPT.

Q: Is TaxGPT secure?

A: Yes, your information is protected with state-of-the-art security measures. We prioritize data privacy and confidentiality.